Trading of Auckland Airport shares was paused for an hour on Thursday after claims by Mayor Wayne Brown the publicly listed company will soon be fundraising for a new domestic terminal.

Brown's Thursday morning comments that the airport was planning a major capital raise came before the company made any announcement to the market. A statement from his office later clarified he didn't have any information not available to the market.

In an update to the market shortly before 1pm, Auckland Airport said it had no plans for an equity raise.

A spokesperson said the airport will continue to speak with airlines about its future infrastructure projects, including its plan to create a combined domestic and international terminal.

"Auckland Airport is planning to fund the new domestic terminal with borrowings."

An announcement on the NZX shortly after midday advised that NZ RegCo - the sharemarket regulator - had placed a trading halt on airport shares.

Trading resumed about an hour later.

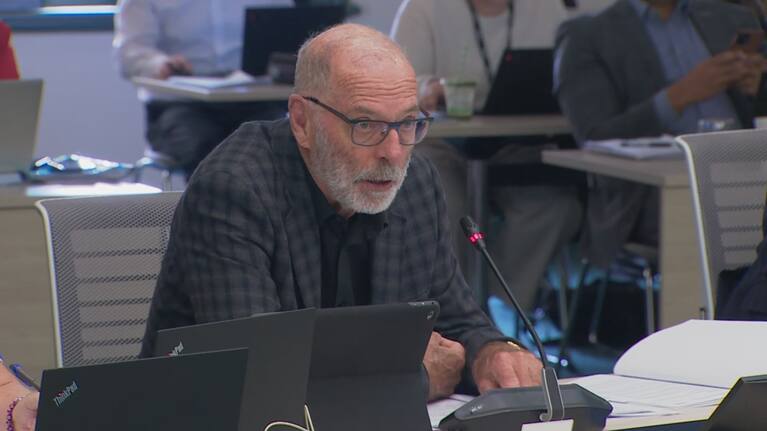

Auckland councillors were meeting to discuss the mayor's budget proposal for the year ahead. Part of Brown's proposals to try and plug a $295 million gap in the council's books includes selling off the council's Auckland Airport shareholding.

As part of discussions, Councillor Greg Sayers asked Brown about the potential dilution of the council's shareholding percentage for the airport.

"Further dilution is almost inevitable," Brown said. "They're about to go on a major raising to fund the new domestic airport."

He continued: "We will not be contributing to that. So our 18% will soon become 11 or 10%. At that stage, it becomes less and less strategic."

Councillor Chris Darby asked whether that announcement had been made to the markets.

"I don't think they've announced it yet, but you don't have to be particularly forward-looking to see that that's coming," the mayor replied.

"There have been statements that are leading towards that. There is a need for a new domestic terminal which they don't have current capital for. So, it's almost inevitable."

Brown is proposing to sell the council's airport shares - worth about $2 billion - to save $88 million in interest costs in the next year.

"The benefit of selling is not just a temporary sugar hit… it will benefit our long-term operating budget every year because the savings of reduced debt are ongoing and every year."

He said having an 18% shareholding meant the council couldn't meaningfully influence the airport, anyway.

'The mayor was speculating'

A spokesperson from Brown's office later said: "Like everyone in the investment community, the mayor was speculating about how the airport company might finance its ambitious capital expenditure programme."

That programme would include numerous upgrades, which were already publicly reported, the spokesperson said in the statement.

"The mayor’s point is that these are all good news for Auckland, but if the airport decides it needs to raise capital for any of them, this would require the Council to either to participate in the capital raise with ratepayers’ or borrowed money, or see its shareholding fall below the current 18%.

"The mayor is not in possession of any information not available to the market."

SHARE ME